Our approach to forecasting

Our mission is to deliver reliable, timely and useful predictions for any metric that is important to you.

We use the best performing forecasting methods including artificial intelligence to develop a customized model evaluated in real-world conditions.

TIMELY

Every relevant information available at the time of the forecast should be exploited. We update our scenarios at a frequency of your choosing, ranging from every minute to every quarter.

USEFUL

A fully-customized approach to forecast the KPIs that are actually useful for you, combined with the tools and commentary needed to make sense of the forecast.

Our 3-step process

Analyzing your problem: we mobilize a high-profile forecasting expert to develop an in-depth understanding of your issue and find the way to implement the best possible forecasting solution.

Developing the solution: we screen all relevant data using a wide range of approaches (artificial intelligence, macro models, time series). We carefully test, evaluate and compare many models to identify the best-performing approach for your specific case.

Implementing the solution: we help you choose the most suitable way of implementing the forecasting solution to ensure its usefulness. Everything is possible: customized dashboards with analysis tools, monthly printable reports, regular meetings with our experts, raw data sharing or even dedicated ERP integration with an API.

Forecasting use cases

Use case examples

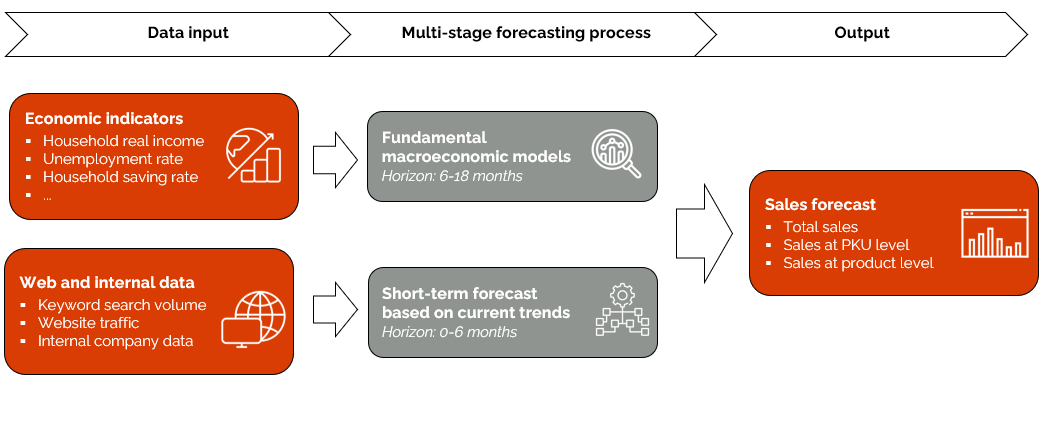

#1 Sales forecasting to guide operations for the e-commerce offering of a cosmetics company

Challenge

The e-commerce offering of the company was faced with a broad range of operational challenges related to fluctuating consumer demand:

- Inventory management.

- Order planning.

- Supply chain management.

Solution

Customized sales forecasting model relying on several pillars:

- Fundamental forecast based on underlying macroeconomic conditions (18-month horizon). For example, a higher inflation will erode the real purchasing power of households, limiting their e-commerce purchases.

- Short-term forecast based on the client’s internal data and website traffic prediction using real-time web data (keyword search volume, etc.).

- Fine-grained modelling of seasonality (at the product level and market level).

- For key products: dedicated machine-learning models based on the product life cycle and performance, historical growth and sales figures and survey results.

Result

Credible forecast numbers used to coordinate operation across business lines and create a sales profile for each geography and product category:

- Reduction of cost associated with inventory and overordering.

- Measurable decrease in product obsolescence.

- Quicker response to an increase in consumer demand, with a positive impact on sales.

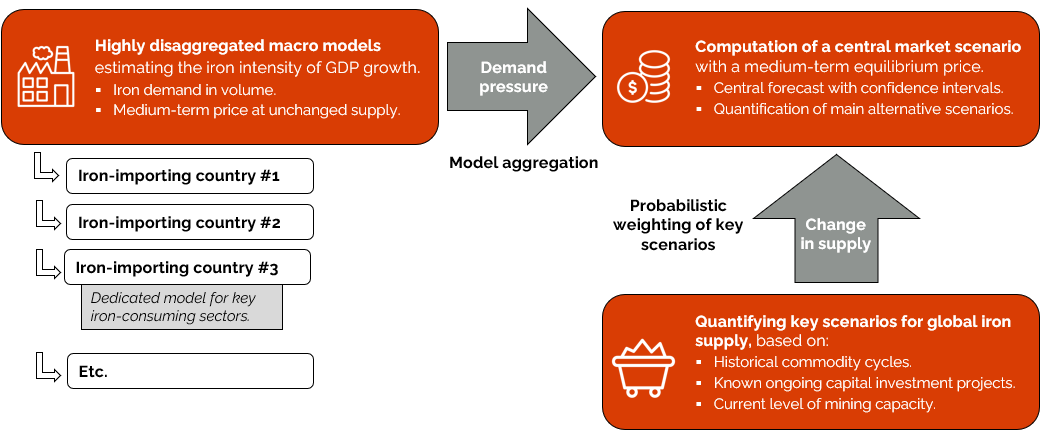

#2 Midterm demand forecasting to guide capital investment decisions for an iron mining company

Challenge

Capital investment projects are highly difficult to plan in the mining industry: they take a particularly long time to pay off in terms of earnings, while the price of mining products is highly volatile and cyclical. The client was in need of better ways to assess the medium-term demand when making a capital investment decision.

Solution

Combination of sector-specific macroeconomic models to estimate medium-term market strength:

- Large number of dedicated macroeconomic models to forecast the demand for iron emanating from each major iron-importing country.

- Sector-specific model for key iron-consuming industries (e.g.: real estate in China).

- Quantification of key scenarios for global iron supply.

- Definition of a medium-term price equilibrium (with confidence intervals).

Result

Accurate medium-term model quantifying market strength to inform capital investment decision, enabling executives to:

- Plan capital investments beyond short-term demand and price fluctuations.

- Limit capital overexpansion at cycle peak.

- Adopt a probabilistic thinking regarding the potential profitability and the risk of each capital investment project.

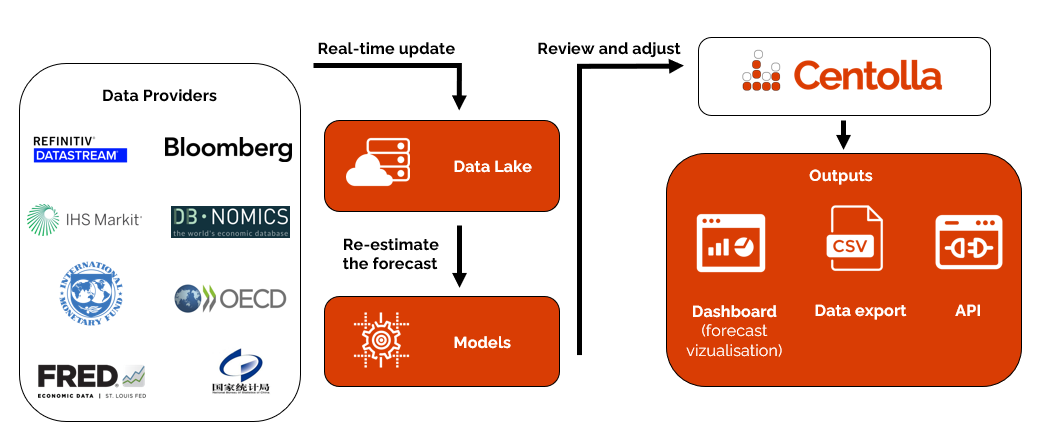

#3 Establishing a macroeconomic and financial forecast database for an asset manager

Challenge

The asset management institution was in need of credible and statistically accurate macroeconomic and financial forecasts in order to:

- Guide portfolio allocation and investment decisions.

- Use as inputs for in-house financial models.

Solution

Deployment of a database comprising a wide range of forecasts for a custom set of macroeconomic and financial variables (e.g.: consumer price inflation, 10-year sovereign bond yield …):

- Out-of-sample historical error performance metrics for every forecast provided to assess its accuracy in an objective manner.

- Dedicated API access and built-in data pipelines to seamlessly integrate the forecast data into the client’s existing infrastructure.

- Daily update of every forecast based on new available economic data.

Result

The client can access all economic and financial forecasts necessary to its investment process at a one-stop database.

- Easy integration into the client’s existing IT infrastructure through custom delivery format and dedicated API.

- Credibility guaranteed by continuous quantification of forecasting accuracy.