An overview of past macroeconomic shocks in Kenya

Leo Barincou, 2022 Feb 02

A first basic definition of a macroeconomic shock

A first and basic approach to identify macroeconomic shock can consist in analyzing declines in total GDP. Most of macroeconomic shocks will cause a sharp decline regarding the growth rate (regardless of the actual source of the shock, external and domestic), which will then impact public finance aggregates such as revenue, borrowing or debt.

But how should we define a sharp decline ?

Here we are going to adopt the definition used by the IMF in its 2016 paper Analyzing and Managing Fiscal Risks—Best Practices. In this document, the materialization of macroeconomic fiscal risks “were identified as those where nominal GDP growth falls by one standard deviation relative to its average”.

This definition has the advantage of being simple, straightforward and therefore very easy to implement, including for international benchmarks.

Application for the Kenyan economy since 1960

Ok, so let’s look at real GDP data in Kenya. Our source here are the national accounts published by the UN (data available online).

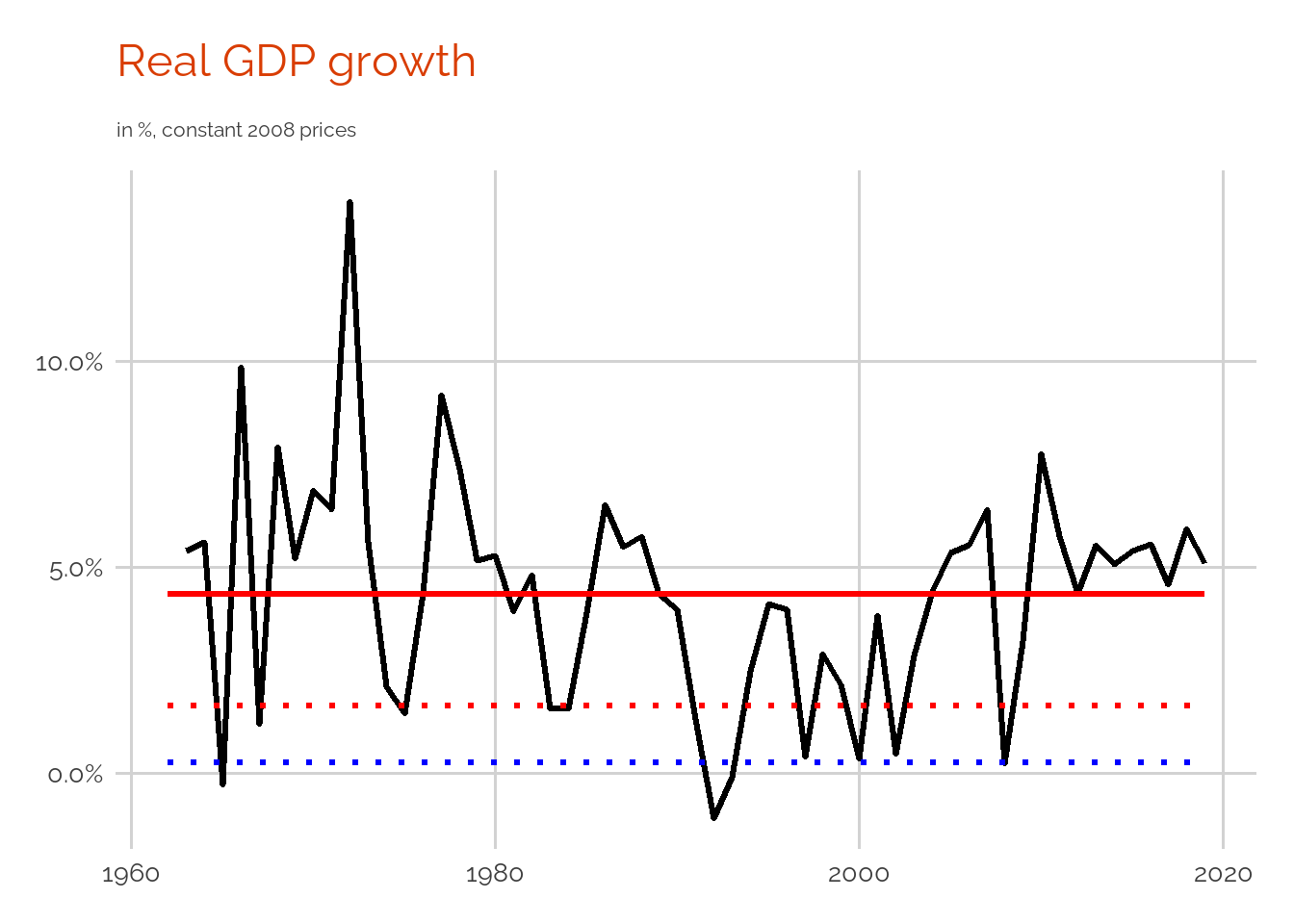

Remember that our definition of a shock involved a fall by more than one standard deviation relative to the average growth. To identify shocks, we first need to compute average growth and the standard deviation of growth (dotted red line). As a comparison we also plot 1.5 standard deviation (dotted blue line).

We can count 12 years for which real GDP growth fell below the shock threshold, which correspond to 9 distinct episodes. So clearly, macroeconomic shocks are actually quite frequent 12 years out of 58 observations, more than 20% of the time.

What happened in 1983-1984 ?

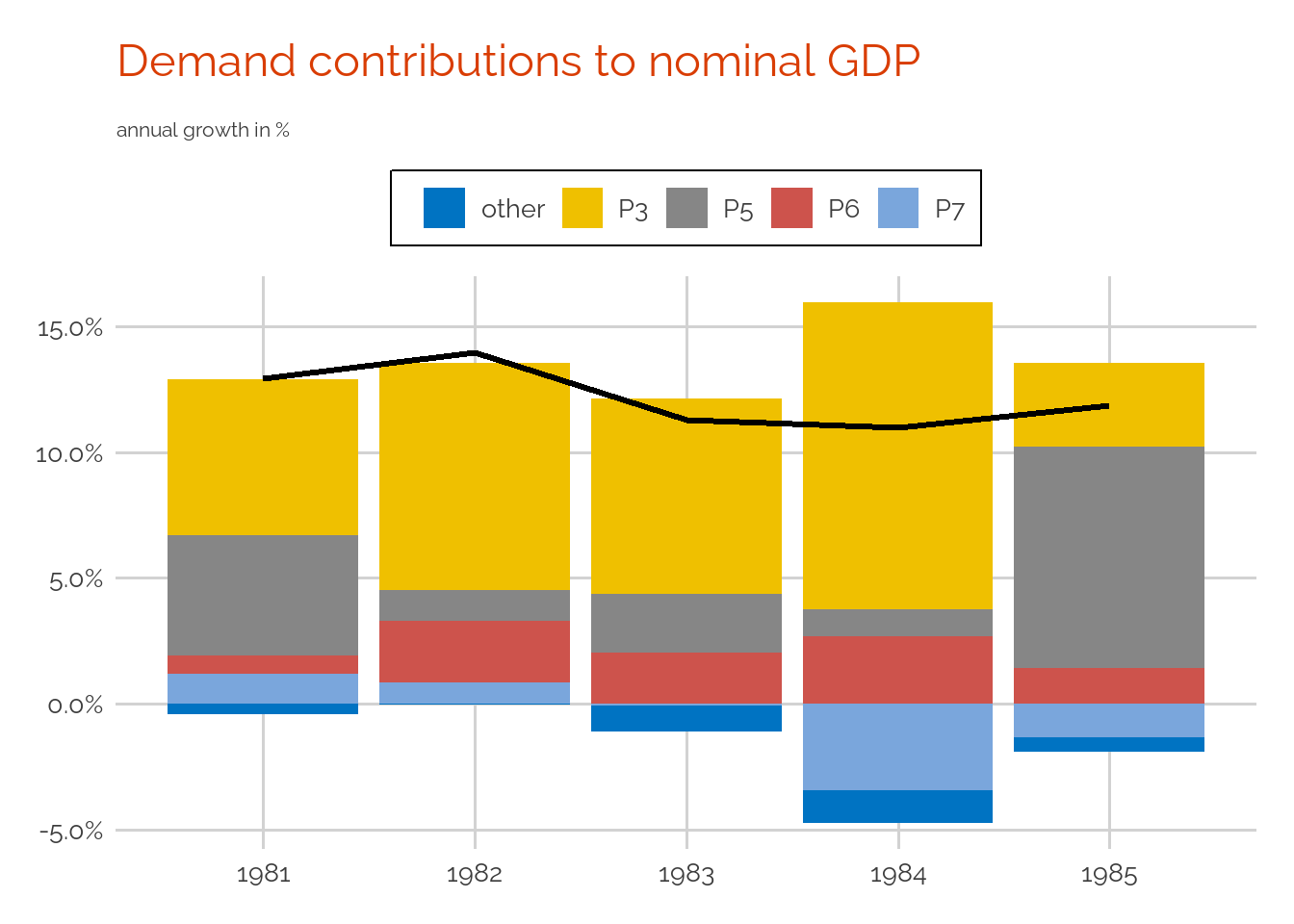

At first sight, the economic downward from 1983 may look mild if we only focus in nominal terms. But this is because the Kenyan economy suffered from a sharp slowdown in real GDP growth (+1.6% in 1983 and 1984 after +4.8% in 1982) jointly with inflationary pressures that supported the deflator.

The main source of the economic slowdown is likely to be the international environment. In the early 1980s most of the world endured the most severe economic recession since WWII following the 1979 energy crisis caused by the Iranian revolution.

The large deterioration of the external balance (B11) for the country can be linked to a decline in world market for Kenyan goods and services during this period.

The sharpest decline in 1983 is on final consumption expenditure (which is likely to be much more detrimental in real terms). In 1984, we can observe a significant rebound on consumption but we see that this rebound is partly addressed by additional imports (negative contributions of P7) while investment slows down (P5).

What happened in 2008 ?

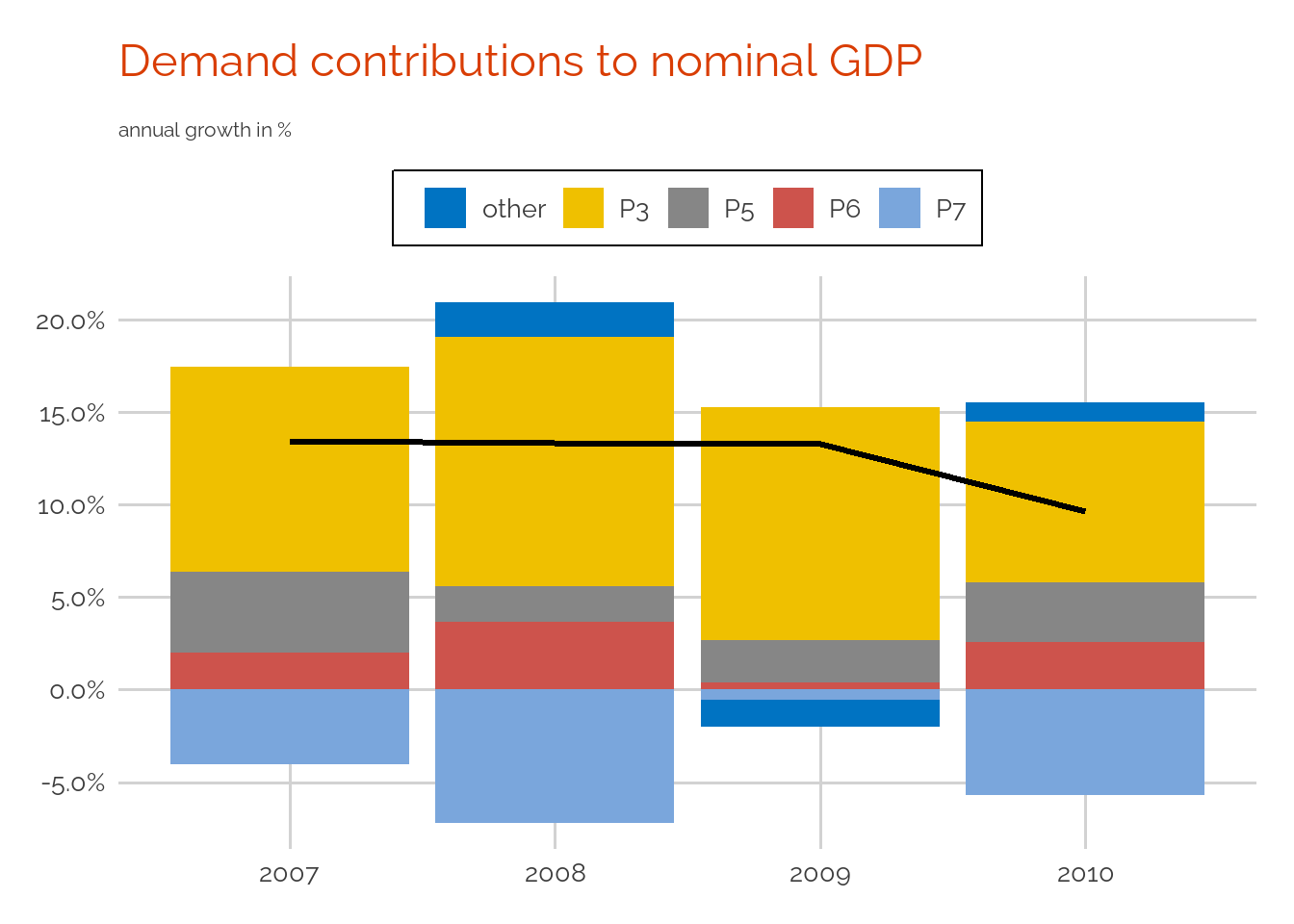

In 2008, real GDP stagnated in Keny (+0.2%) in the context of the global financial crisis.

Once again, nominal aggregates send mixed messages because of inflation (nominal growth is stable in 2008-2010). But a clear sign of the economic downturn and the confidence loss during this period is the sharp slowdown in investment (+9.6% in current prices in 2008 after +21.2% the year before).

Contactez nous

Envoyez nous un message ci-dessous et nous vous répondrons.